Overview

We have a robust risk management framework in place to identify, measure, monitor and manage the critical risks we face. The framework, including policies and procedures, is regularly reviewed and enhanced in response to changes in the external environment and business processes.

We proactively evaluate our risks and ensure coverage against our exposure. Our strategic and operational decision-making process continues to be strengthened through transparent communication and risk awareness across the organization, while ongoing compliance with risk management processes is regularly reviewed.

Foreign Exchange Risk

Our reporting currency is U.S. Dollars (USD). The Group operates in both developed and emerging markets and is exposed to foreign exchange risk in our normal course of business. In our larger markets, exports from Africa and Malaysia are mostly denominated in USD while imports into China are denominated in either USD or Renminbi. The majority of our expenses and sales elsewhere are denominated in the respective local currency. We manage our foreign currency risk through executing hedges in the over-the-counter foreign exchange market, product pricing and structuring natural hedges in our business where possible. These strategies mitigate the adverse impact of foreign exchange volatility on our financial position.

Interest Rate Risk

A substantial portion of our borrowings is in the form of trade finance and short-term banking facilities. These are used to fund operations and are transaction-related. Interest expense arising from such financing is subject to the stock holding period assumed at the time of entering into the transaction versus the actual time taken to deliver the physical product and realize the proceeds of sale from the end-customer. Consequently, interest expense is dependent on the volume of transactions and the cash conversion cycle, and it is subsequently priced into the products. As such, short-term interest rate movements do not have a significant impact on the net contribution margin. We also obtain term loans from banks to fund our capital expenditures and working capital requirements. Interest rate risk arising from floating rate exposure is managed through the use of financial instruments, such as futures and swaps, with the objective of limiting the adverse impact from a rise in interest rates.

Credit Risk

The majority of our sales are export sales in bulk, for which documentary credit from customers are required. For domestic sales in China and other neighboring countries and some specific countries, we may grant our more substantial customers credit terms while requiring cash on delivery or advance payment for others.

New customers’ credit worthiness is evaluated by considering their financial standings and operating track records as well as conducting background checks through industrial contacts. In this regard, we benefit from the experience and local knowledge of our wide manufacturing base and distribution network. Actual credit terms and limits to be granted are decided based on the information obtained, and revised according to economic or market conditions. As a practice, we will usually require documentary credit or advance payments for sales to new customers.

Credit facilities granted to existing customers are also reviewed periodically. A customer’s current financial strength, payment history, transaction volume and duration of business relationship with us are taken into consideration.

Risk Governance

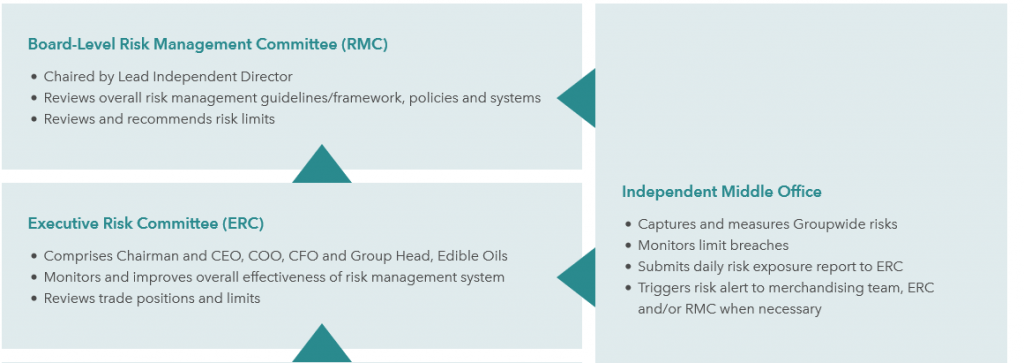

Our risk governance structure comprises the Risk Management Committee at the Board level, the Executive Risk Committee and risk management by the respective operating units. The Board-level Risk Management Committee, chaired by the Lead Independent Director, oversees the Executive Risk Committee, reviews the overall risk management guidelines/framework, reviews and recommends risk limits as well as assesses the adequacy and effectiveness of the risk management policies and systems.

The Executive Risk Committee comprises the Group’s Chairman & Chief Executive Officer (CEO), Chief Operating Officer (COO), Chief Financial Officer (CFO) and Group Head, Edible Oils. Its responsibilities include, amongst others, the monitoring and improvement of the overall effectiveness of its risk management system, the review of trade positions and limits to manage overall risk exposure.

The heads of operating units are responsible for monitoring their respective risks and adherence to trading policies and limits set by the Risk Management Committee and the Board.

To achieve effective governance and oversight by ensuring proper segregation of duties, we have a Middle Office which is independent of the front and back office. The Middle Office is responsible for the tracking and measurement of Group-wide risks as well as monitoring adherence to limits. The Middle Office circulates a daily risk exposure report, which is reviewed by the Executive Risk Committee for any significant risk issues. The Middle Office also sends out regular risk alerts to the merchandising team and the Executive Risk Committee when risk exposure is seen to be nearing trigger levels.

The documented risk management policy, which is regularly reviewed, clearly defines the procedures for monitoring, controlling and reporting risk in a timely and accurate manner. We have in place an overall risk tolerance threshold recommended by the Risk Management Committee and approved by the Board. The risk tolerance threshold refers to the maximum potential loss of all open exposures across major products and geographical regions at any given time. The risk tolerance threshold is determined after taking account of the Group’s equity strength and profitability as well as our overall production capacity, price trends of raw materials, management’s overall view of the market, track record of the management of risk exposure in the prior period and financial budgets including projected sales volumes and turnover.